The Hindu Business Line

12th December 2016

Good news round the corner

While demonetisation is a worry, the company’s long-term prospects look good

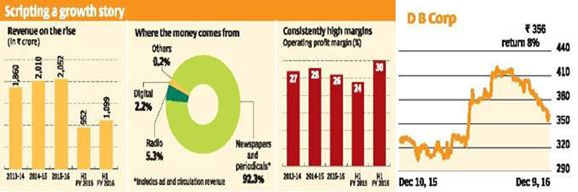

The stock of DB Corp, publisher of the leading Hindi daily Dainik Bhaskar, has gained only around 9 per cent since our buy call a year ago. A tepid show in 2015-16 seems to have weighed on the stock. There has, however, been a strong rebound in performance in the latest June and September quarters. At Rs. 356, the stock trades at around 22 times its estimated 2016-17 earnings. This is inexpensive, given the stock’s five-year valuation band of 16-25 times. With the company's long-term prospects looking good, investors can consider buying the stock.

An expected rise in ad revenue, which accounts for about 70 per cent of DB Corp’s consolidated revenue, should hold the company in good stead. DB Corp also stands to benefit from its growing presence in the promising Indian radio industry. Its radio business, though a small contributor to revenue, has done well over the years.

Ad revenue to rise: DB Corp posted an over 2 per cent (year-on-year) decline in ad revenue to Rs. 1,481 crore in 2015-16. This was followed by a nearly 15 per cent Y-o-Y jump in ad revenue to Rs. 788 crore in the half year ended September 2016. Drop in ad volumes, a result of the conscious hike in ad rates by the company, impacted ad revenue, last fiscal.

But, with ad volumes picking up in the current fiscal notwithstanding the higher rates, revenue grew at a healthy pace. Higher ad spends by educational institutions, the government and auto companies boosted numbers. These segments, which are big contributors to ad revenue, are expected to do well in the coming quarters too. DB Corp should also benefit from a likely boost to consumption and, therefore, to advertising spend from the implementation of the Seventh Pay Commission recommendations and good monsoon.

It is also well placed to gain from election-related ad spending by political parties in several poll-bound States over the next few years. DB Corp’s big markets are set for elections — Punjab and Gujarat in mid-2017 and Chhattisgarh, MP and Rajasthan in end-2018. This will be followed by the general elections in April 2019. In the near term though, ad spends by sectors such as FMCG, real estate and lifestyle that have been adversely impacted by demonetisation, will take a hit. These sectors, however, account for a small portion of the company’s total ad revenue.

Small support: DB Corp, which publishes the flagship Hindi daily Dainik Bhaskar, Divya Bhaskar (in Gujarati) and Divya Marathi, is circulated across 14 States. Supported by cover price increases and higher volumes, the company has grown its circulation revenue (30 per cent of consolidated revenue) at double-digit rates for many years. For the half year ended September 2016 too, it grew at 13 per cent to Rs. 236 crore. But the growth is likely to ease from the next fiscal. DB Corp intends to rely on higher volumes and not cover price increases and is targeting a 5 per cent growth in circulation revenue in the coming fiscal. It is betting on the growing reach of newspapers in tier I and II cities to drive volumes.

Transmitting growth signals: Apart from its primary newspaper business, DB Corp is also present in the radio space. It runs 20 live stations (including three recently launched ones) of the MY FM radio station across seven States. With its growing spread across the country, FM radio has been emerging as an important platform for advertisers. This will be particularly so once the next round (batch two of the third phase) of auction of frequencies, which are largely in tier II and III cities, is concluded.

And while the radio business currently contributes only 5 per cent of DB Corp’s consolidated revenue, margins are high. For the half year ended September 2016, the radio business reported profit (before interest and tax) margin of 36 per cent, up from 22 per cent a year ago. As the company expands its presence in the radio segment, its contribution to the overall business should go up in the years to come. DB Corp bought 13 new frequencies in the third phase (batch one) of radio auctions held last year, three of which turned operational a few months back. It usually takes two to three years for a radio station to break even at the operating profit level.

Financials seem good: Boosted by a healthy growth in print advertisement and circulation revenues, DB Corp grew its consolidated revenue by 16 per cent (Y-oY) to Rs. 1,099 crore in the half year period ended September 2016. This helped the company post a 45 per cent rise in operating profit to Rs. 332 crore and a 59 per cent jump in net profit to Rs. 193 crore during this period. DB Corp, which has enjoyed high double-digit margins in the past too, reported an operating profit margin of 30 per cent (up from 24 per cent a year ago) and net profit margin of 18 per cent (up from 13 per cent a year ago) for the half year period ended September 2016.

Higher costs on account of new newspaper launches had impacted margins last fiscal. An expected rise in newsprint prices and the launch of new editions in Bihar and higher circulation numbers can bump up raw material costs in the coming quarters. While the company faces some headwinds in the near future in the form of demonetisation and slower growth in circulation revenue, its long-term prospects look intact. This will be achieved, thanks to a healthy growth in the company’s ad revenue (print and radio), the mainstay of any media industry player.

DID YOU KNOW?

DB Corp’s operating profit margin improved to 30 per cent during the half year ended September 2016 from 24 per cent a year ago

WHY?

Ad revenue expected to grow

Expansion of radio business

Inexpensive valuation