Impact Weekly Magazine

14 July 2014

Advantage Bhaskar

As brands shift focus to Tier II and Tier III cities, the DainikBhaskar Group cashes in on its investment in these markets to garner a major share of ad revenues.

Give me but a firm spot on which to stand, and I shall move the earth. - Archimedes.

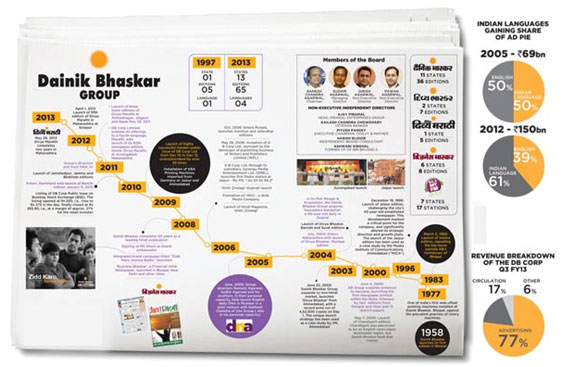

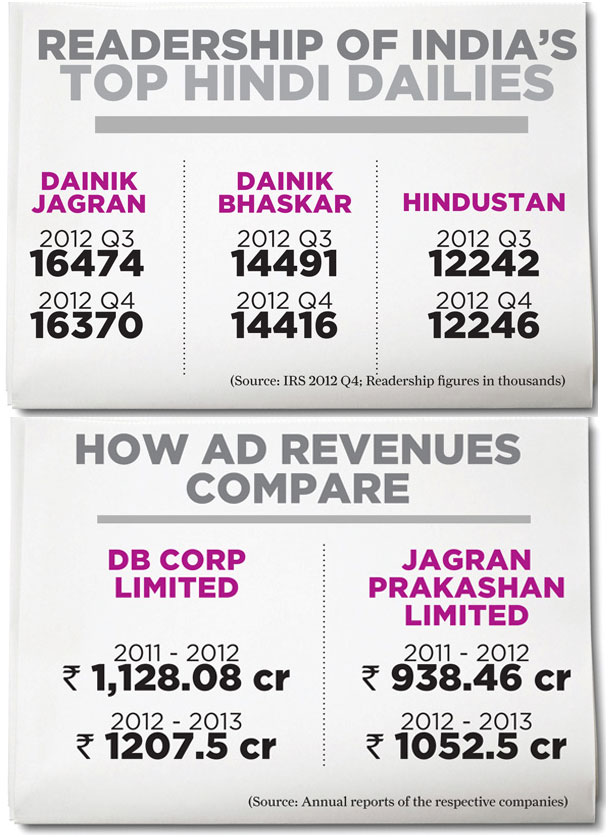

As Archimedes famously said centuries ago, explaining the working of the lever, all one needs is half an opportunity and a lot of intelligence to move the earth. Cut to the present and the ad-media marketing world, and his wisdom stands true as ever. As all brands shift focus to tier II and tier III cities, riding on the promise of growth due to rising consumerism, there is a buzz among the major media players in these markets to cash in on the opportunity. One player that has done better than all others on this front is DainikBhaskar Corporation Limited (DBCL), using foresight and intelligent positioning of products to bag a substantial share of the advertiser's budget in these markets. thoughDainikBhaskar, the group's flagship newspaper, stands at no 2 in terms of readership among Hindi dailies according to the Indian readership survey (IRS), it is a clear leader when it comes to advertising revenues.

ADDING UP THE NUMBERS

The DainikBhaskar group's profits are more advertising-driven than circulation-driven, while rival JagranPrakashan Limited (JPL), the leader in terms of readership, seems to have more circulation-driven profits. For FY 12-13, the Bhaskar group's ad revenue stood at rs 1,207.5 crore, while circulation revenue Was at rs 282.3 crore. Jagran, on the other hand, garnered ad revenues to the tune of rs 1,052.5 crore while its circulation revenues stood at rs 319.2 crore for the same year. Overall profits compare at rs 1,613.7 crore for DBCL against JPL's rs 1,525.5 crore for the just concluded financial year. Girish Agarwal, Nonexecutive Director of DBCL, explains that the group's strategy to remain on top in terms of ad revenues is to leave absolutely no room for any new incumbent to come in easily in their markets. "even after five years, the no. 2 newspaper in Madhya Pradesh, I am told, has a bleeding balance sheet. Our strategy is not to charge a higher cover price beyond a point, but t o increase penetration in that market," adds Agarwal.

The advent of other players in the group's home market of Madhya Pradesh doesn't seem to faze Agarwal either. "We have around 50 lakh readers in MP and Chhattisgarh markets. The no. 2 player has just completed five years, and their total readership is at 17 lakh. Numbers tell the whole story," he says.

DBCL operates on a strategic business model that tracks various categories for their trend of marketing spends, demand potential and growth prospects. The data-analytics-driven planning enables a sustained revenue generation. "the opportunity in tier II and tier III markets provides us the impetus to move forward and be true catalysts and partners in the rapid socio-economic change. Hence, we remain confident about future revenue prospects," asserts Pradeep Dwivedi, Chief Corporate Sales & Marketing Officer of DBCL.

Even media planners laud the group for its aggressive approach in building numbers. "the DB group had the foresight to expand in tier II and tier III markets much before the growth started and now they are reaping the benefits," says Suresh Balakrishna, CEO, BPN India.

WHY NOT UP AND BIHAR?

The 55-year-old group's expansion spree began with its first foray outside its hometown, Bhopal, in 1983 with the launch of its Indore edition. It has continued since, first moving out of Madhya Pradesh to other states, and then venturing into non-hindi speaking markets with Gujarati and Marathi language newspapers.

However, dainikBhaskar surprisingly does not have a presence in Uttar Pradesh, the largest state in the hindi belt, or Bihar. Asked whether the group plans to enter these states, Agarwal says, "We just launched Divya Marathi in Maharashtra two years back. It has been a very encouraging market so far, and we plan to launch in Akola and Amravati this year itself. We are tied up with expansion in our markets. We are keeping an eye on other markets, but can't comment as of now. I am not too sure about UP, as it is not a very lucrative market. We have evaluated some markets, but no decisions As yet."

Meanwhile, the group has launched a digital-only edition for UP, as an experiment. According to Agarwal, the response has not been "amazingly good". "Unfortunately, since we don't have a huge background in UP, people don't relate us to UP. It will take some more time," he says.

In Maharashtra, Divya Marathi seems to have hit the right chord with sec AB readers, but beyond that, the group is yet to gain traction and volume in the market with tough competition from players such as Lokmat, Maharashtra times and sakaal. Agarwal's contention here is that the advertising is all about sec A and B, and so there is no point focusing on C or d or any other category. The group's radio offering 4.3 FM too, follows the general DB focus on nonmetro cities and their own markets. With Phase III auctions in the offing, the areas in which 94.3 FM is likely to bid for stations is the Group's existing markets. "Markets which are opening up newly in the radio business, we'll take those, but we will not look at any metro or beyond our markets. Will I take a radio station in the South? No," states Agarwal.

As for mergers and acquisitions (M&As) to expand re-ach, while the NaiDunia and Mid-Day acquisitions proved lucrative for competitor Jagran, DBCL is not looking at M&As just now. "However, if it is sensible, rightly priced and the right opportunity, we would be open to looking at it," Agarwal says.

BALANCING THE BUSINESS

DBCL's business model is based on key markets equally contributing towards top-line, bottom-line and readership, apparently to reduce the dependability on any one single market. The strategy is not to be focused on any particular market, though newspapers worldwide have traditionally been focused on a particular State or region, often having these places names coined in their mastheads. "We took this call way back in 1995. As dependability goes up on any one market, and its politics and economics, if something goes wrong there, you are done for. We are happy that we are present in 13 States, and all these 13 markets are doing well for us. The idea is that every market should be self-sufficient," says Agarwal.

ROPING IN ADVERTISERS

What does the DainikBhaskar Group do to garner more advertising revenues, and make its products a better environment for the advertiser? Agarwal quotes Mahatma Gandhi here: 'Focus on the end and the means will follow.' The strategy is not to chase advertisers, but to consider the reader as the end, and advertising as the means. "You need to have the right reader, because the advertiser is actually advertising to reach out to a particular consumer; so if I am able to get the consumer, he will come to me," comments Agarwal. At the same time, the Group offers multiple solutions to the advertiser, even helping brands to reach out to their target group, knowing when and how these consumers read its newspapers. While integrated advertising exists for the Group's Print editions pan India, would it not help the advertiser if there was integrated advertising offered with Digital or even Radio within the Group? Agarwal rubbishes offering a 360-degree approach as "jargon", saying agencies and clients are not geared that way. "There are different parameters to evaluate the cost effectiveness of all these media. Not only in India, worldwide not much business is happening in an integrated manner," he says.

INTERVIEW: We are an editorial success, fantastically marketed to the consumer, says Girish Agarwal

When he was barely 16 years old, Girish Agarwal started taking an interest in the working of the DainikBhaskar Group. That was almost 26 years ago. Today, Agarwal, non-executive director of the Group, spearheads the marketing and related operations of the business, entering new markets and ensuring that the Group's media products stay relevant to both consumer and advertiser. Agarwal is also an active member of industry bodies such as the Indian Newspaper Society (INS). Apart from business, the soft-spoken Agarwal has many tales to tell about his sojourn at DB Group from such a young age. A random field visit, when a consumer mistook him for someone from the competition, and reluctantly praised DainikBhaskar. Early on in his career, industry veteran Roda Mehta making him realize the importance of going prepared for meetings. And, of course, his father, Group Chairman Ramesh Chandra Agarwal, teaching him many lessons… for instance, the value of being on time for meetings (they had once travelled all the way from Bhopal to Mumbai for a particular meeting, but got late eating lunch!) Here are excerpts from a conversation SrabanaLahiri had with Girish Agarwal

Q] The business strategy and marketing of the DainikBhaskar Group has been the subject of an IIM-B study for entering Tier II and Tier III markets with strong and entrenched incumbents and making significant progress. How did you get readers to change their newspaper habits in these markets?

Tier II and Tier III cities are at the core of our business strategy, as we firmly believe that the growth in India is happening beyond the metros. These cities don't have optimum market penetration, and hence offer more growth potential. When we launched in Jaipur, Ahmedabad and most recently Aurangabad, market penetration in all these markets by the existing player was not up to the threshold number, so there was a vacuum that we could fill. It is a task to attract a consumer who has always read the existing newspapers, but somehow never been tempted by them. We create the kind of newspaper he likes, with his help and understanding his requirement. So far, in most new markets, our products have been very encouraging as they are literally designed by the readers themselves. There are always some fencesitters, who opt for a new player, so that too is our advantage. We are seen as a marketing success, but to be honest, we are largely an editorial success, fantastically marketed to the consumer.

Q] With consumption of content increasingly on mobile and other screens now, where do you see the Print medium going in the future? What is the Group's digital strategy?

Currently, we are at around 5% broadband penetration in India; we have a long way to go. Once it is at a fairly high penetration, the first to be hit will be the English newspapers in the metros. But I can't say that nothing is going to happen to me for at least 10 years, and relax. We are working a lot on the digital platform so that whenever the transition happens, the consumer stays with us, because we want him to come to us for news, be it on Digital, Print or Mobile medium. Today, we have almost 250 million page views on a monthly basis on our websites; we have the largest Hindi and Gujarati news portals.

Q] Nowadays, creative agencies are not going strong on Print. How do you see this affecting advertising in the Print medium?

It's true that the whole charm of Print advertising has gone down. Creative agencies and publication houses are jointly to blame. Both need to sit together and see how we can make it look better. TV has become 'sexier', in terms of creative outlook, whereas Print is just about fine. The true potential of Print advertising is yet to be explored. But business-wise, 46% of the advertisers' ad budget still goes to Print. So the poor advertiser suffers. In fact, the advertiser should drive it; demand a separate creative concept and shoot for Print, rather than being the offshoot of TV. Creating a striking Print ad is real hard work, as you have to talk to a consumer with a static picture.

Q] The DainikBhaskar Group made headlines with the much publicized launch of DNA in Mumbai. You still run the Ahmedabad, Jaipur and Indore editions, but why did you exit from DNA in the first place?

That is the call of the family. We thought growth is largely happening in cities beyond the metros. After assessing the muted English readership growth along with metro market consumption decline, we decided to exit from DNA in 2010. We are living in a very dynamic market. What looked viable in 2004 and 2005 was no longer the same in 2010; the market changes were visible. Taking risks is an integral part of the business. So that was a part of it.

Q] Are you going to enter the English dailies market anytime in the near future?

No

Q] How do you plan to go back to the 30-35% growth rate that the Bhaskar Group had in its initial years?

I wish it could happen this month itself! Growth is the combined end result of hard work, market conditions, shape of the economy, overall consumerism in the country, and so on. When we achieved 30-35% growth, it was because of the team's hard work, the country's 8.5-9% GDP growth, and newly emerging consumerism. To achieve that number again, we would have to get everything back in order — a stable government, a stable economy, a stronger rupee, high GDP growth...

Q] Your product DB Star has some pages in English meant for youngsters. Do you think youngsters will read English and not Hindi in the future?

Please understand that youngsters are not the youngsters of Mumbai or Bhopal or Jaipur alone. They are also from Jagdalpur, Kota, Barmer, SawaiMadhopur, Anand, etc. We have those pages only in select markets. DB Star doesn't go to Jagdalpur or Nanded, it goes to large cities, where we feel there are some audiences connecting with the English language. It is all about how we stay relevant. We tried some pages in English to see how the consumer connects with that. It is again an experiment; one has to keep doing it.

Q] Going ahead, what is the mantra for building brand Bhaskar?

Brand is nothing but an outcome of your relationship with your consumer and internal working on your product. If we stay focused on our consumer, and our offerings, I am sure Brand Bhaskar will continue to grow. In Maharashtra, the brand is called 'Divya Marathi'. We experimented by not using the word 'Bhaskar' in our masthead and yet we have been successful in the market. It is not about a name, but giving the right product to your consumer, and then everything emerges on its own.

Q] What are some of the challenges you see in the functioning of the group?

The biggest challenge is how to stay relevant for our consumers, because they are changing every day; society and how people react to particular situations are changing. Manpower, production, advertising growth are issues one can handle. We are not a male- or female centric brand. We talk to the entire family — we address a housewife, a working lady, a young son, an earning male member, retired parents; all of them are important. We have to ensure that they all spend that half-hour every morning on our brand.

Q] What are the focus areas for next year?

One big focus is how we further grow in terms of numbers and reach in our existing markets. In Madhya Pradesh we increased the cover price by almost 5-6%, still we were able to grow by some 40,000-50,000 copies. Another focus area is editorial. We have done a lot of changes in the last couple of years. I am very happy with the fact that my editorial team now speaks a different language altogether. We stand a class apart, compared to all other newspapers in the country, including English dailies. Recently, someone from a large group joined our Marathi newspaper, and he said, "Whatever I have learnt in the last 25 years, I feel you guys are miles ahead." That is a big compliment coming from a senior editor, who has been in mainline journalism. We have also tied up editorially with major publications, such as TIME magazine and Harvard Business Review.

Q] Are there any new businesses or expansion plans on your agenda this year?

Radio will expand, with the new auctions happening. We are launching a few more editions in Maharashtra, as well as more printing centres in Madhya Pradesh, Rajasthan and Gujarat. In fact, we don't sleep well; we have to do something or the other. The group is constantly on the move.